2 capsules/Day

as Low as

12.00 GBP /month

2 capsules/Day

as Low as

12.00 GBP /month

The following is a general introduction to ingredient properties, not product claims

Relieves arthritis pain*Meta-analysis of 10 studies shows curcumin eases knee-OA pain, comparable to NSAIDs.

Curcumin, a phytochemical common in Asian cuisine, is antioxidant, anti-inflammatory, and antifibrinogenic. This study showed curcumin mitigated Huntington’s disease model symptoms by inhibiting cell death, indicating potential with minimal side effects.

Curcumin improves systemic oxidative-stress markers and boosts antioxidant enzymes such as SOD, CAT, and GPx, reducing cellular damage.

Curcumin acts as an immunomodulator and potential adjuvant against infectious diseases—clinical trials with curcumin as adjunct are needed.

Research evidence on the substance Curcumin

The efficacy marked with * has been partially substantiated by research, and effects may vary among individuals.

Four major signs of systemic inflammation

Product Profile

Curcumin

Authorized Factory

Certification

FDA, HACCP, GMP, ISO 22000

Hong Kong pharmaceutical qualifications

Curcumin

Suitable For

Adults 18 +, high inflammation, frequent alcohol, night shifts, joint discomfort

Not Suitable For

Under 18, pregnant or breastfeeding is not advised; menstruating women use cautiously (curcumin has anticoagulant action and may increase bleeding).

Severe liver or bile-duct disease: do not use Multiple medications—antihypertensives, diclofenac, blood thinners, Hashimoto’s drugs, immunosuppressants—consult doctor before use

Scheduled for surgery within 2 weeks—stop use at least 2 weeks in advance

If symptoms such as jaundice, dark urine, nausea, vomiting, extreme fatigue, weakness, stomach pain or abdominal pain, loss of appetite occur, discontinue use immediately

Specifications

60 capsules/bottle

1 bottle = 1-month supply

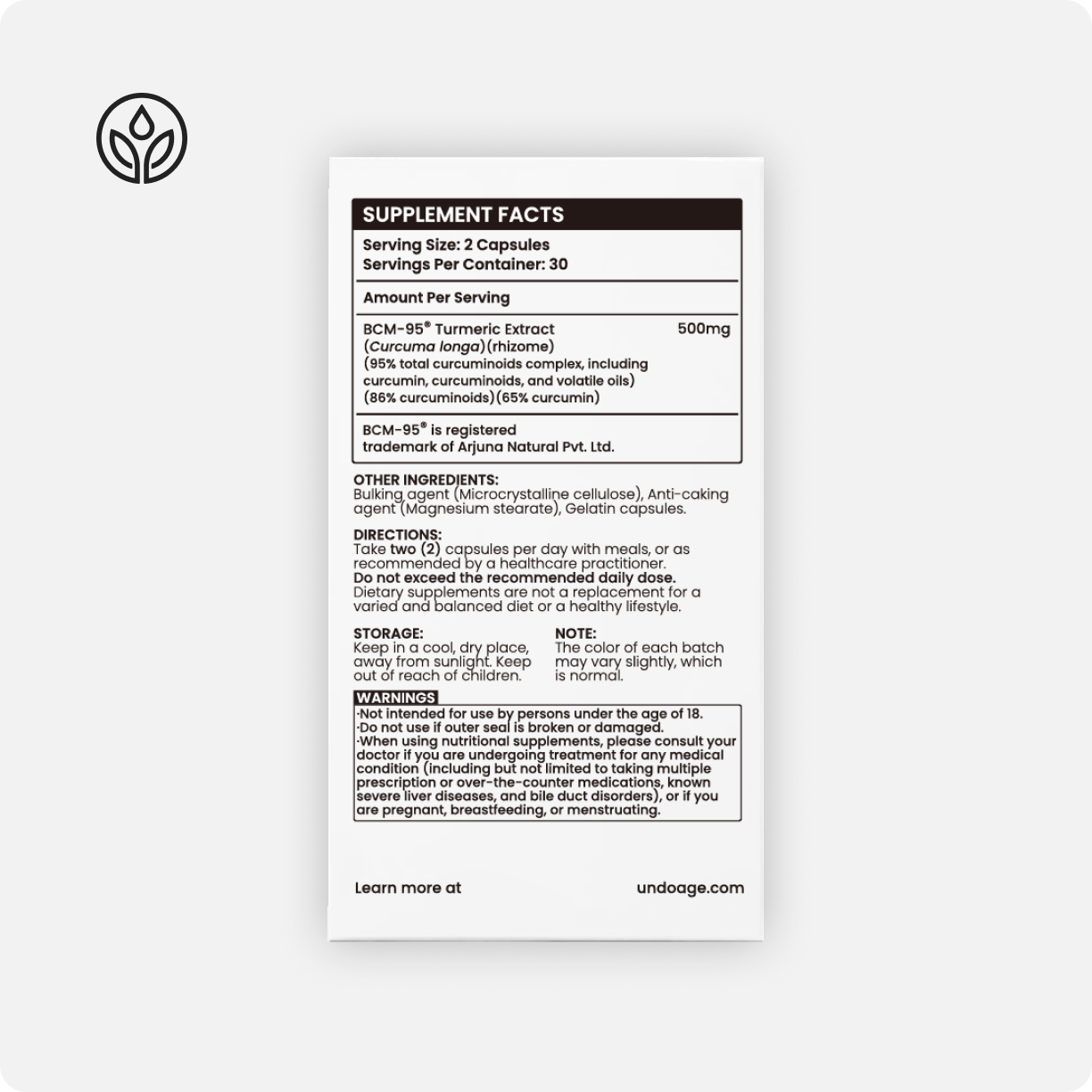

BCM-95® Curcuma extract

500 mg

(standardized to 95 % total curcuminoids with rhizome oil)

Other Ingredients

Microcrystalline cellulose, magnesium stearate, gelatin capsule.

Directions

2 capsules daily with meals

To optimize the body’s adaptation to nutritional supplements and maintain homeostatic balance, a cyclical dosing strategy is recommended (e.g., every 3 months, discontinue for 2–4 weeks). Curcumin has some mucosal irritant properties and may increase gastrointestinal motility; sensitive individuals or first-time users may experience stomach discomfort. It is recommended to take it with meals or immediately after eating; for first-time use, start with a low dose (one capsule per day) and adjust according to tolerance.

Shelf Life

24 months/36 months

(subject to the actual product received)

Storage

Keep in a cool, dry place, away from sunlight. Keep desiccant inside and tighten cap after opening

Disclaimer

*The effects mentioned above are based on scientific research related to the ingredients, with references available upon request from our customer service.

Due to variations in production batches and manufacturing processes, there may be differences in the appearance of the product (such as capsules/tablets/form/colour), printing styles, and outer packaging. However, all products meet safety standards, so please rest assured.

Cautions

Return Policy

If you are not completely satisfied with your purchase, please contact us via email. We will recommend the most suitable solution for you. Thanks to our adherence to industry-leading standards and UndoAge's quality assurance, customers rarely need to return products. However, if a return is necessary, rest assured that we will ensure a safe and hassle-free process.

We offer a 14-day worry-free refund guarantee for every order. Upholding our customer-first principle, we will:

Important Notes:

1. Return shipping costs must be borne by the customer.

2. To request a refund, please email

○ Order number

○ Photos of the product

○ Proof of purchase

○ Reason for return

Refund Processing Times:

1. Return review: up to 7 business days

2.Refund issuance: 7-14 business days after approval

Shipping information

Order processing time 1–2 business days; in-stock items ship immediately; pre-sale items ship according to the specified release dates

Reference for Regional Tax Standards

According to the Customs Tariff Policies of Various Countries, for products purchased personally by consumers, if customs duties are required, you will need to handle the payment yourself in accordance with the local laws and regulations.

| Country / Territory | Duty-Free Allowances | Duty-Free Allowances (USD) | General Trade Import of Supplements / Dietary Supplements Import Duty Rates |

|---|---|---|---|

| Japan | JPY 100,000 | Approx $75.71 USD | 0% - 5% (depending on product) |

| United States | None From May 2nd 2025, small parcels under $800 incur duties of 120% of value or $100 per item (whichever is higher); from June 1 2025, the flat fee rises to $200 per item. |

- | Import Duty: 145% (as of now) State Sales Tax: TBD |

| Taiwan | TWD 2,000 | Approx $65.71 USD | 5% import duty + 5% business tax |

| Canada | CAD 20 | Approx $15.71 USD | 0% import duty, but 5% - 15% GST/HST applies |

| South Korea | USD 150 | - | 8% import duty + 10% VAT |

| Singapore | SGD 400 | Approx $308.57 USD | 0% import duty, but 8% GST applies |

| Australia | AUD 1,000 | Approx $671.43 USD | 0% import duty, but 10% GST applies |

| Netherlands | EUR 150 – duty-free; EUR 22 – VAT-free |

Approx $162.86 USD, duty-free Approx $23.86 USD, VAT-free |

Import Duty: 9% Standard VAT: 21% |

| Germany | • €45 – duty & VAT-free • €45 - €700 – flat 17.5% on declared value (excl. shipping) • >€700 – standard duties and VAT apply |

Approx $48.86 USD | • Up to €150 (~$162.86) tax-free; 19% VAT (7% on some goods) applies • Over €150 (~$162.86): 9% import duty + 19% VAT |

| Italy | EUR 150 – duty-free; EUR 22 – VAT-free |

Approx $162.86 USD, duty-free Approx $23.86 USD, VAT-free |

0% - 17% import duty (depending on product) + 22% VAT |

| France | EUR 150 | Approx $162.86 USD | 0% - 17% import duty (depending on product) + 20% VAT |

| Spain | EUR 150 – duty-free; EUR 22 – VAT-free |

Approx $162.86 USD, duty-free Approx $23.86 USD, VAT-free |

0% - 17% import duty (depending on product) + 21% VAT |

| New Zealand | NZD 60 | Approx $35.43 USD | 0% import duty + 15% VAT |

| United Kingdom | GBP 135 – duty-free; GBP 15 – VAT-free |

Approx $177.43 USD | 0% - 17% import duty (depending on product) + 20% VAT |

| Thailand | THB 1,000 | Approx $30.57 USD | 0% import duty + 7% VAT |

| Indonesia | USD 3 | - | Imports under $3: duty-free + 11% VAT $3 - $1,500: 7.5% import duty + 11% VAT Over $1,500: Most-Favored-Nation rate (0% duty) + 5% - 15% VAT (12% for fish oil) |

| Malaysia | RMB 5,000 | Approx $714.29 USD | 0% import duty |

| Brazil | USD 50 – tax-free | - | Import Duty: 9% (simplified regime; goods valued $50 - $3,000 incur a flat 60% CIF-based duty) State Consumption Tax: 17% - 19% (simplified regime: 18% on CIF + import duty) |

| Mexico | USD 50 – duty & VAT-free | - | 10% import duty + 16% VAT + 0.8% deferred tax on CIF + import duty |

| Vietnam | VND 1,000,000 – duty-free | Approx $40.50 USD | 10% import duty + 10% VAT |

| Hong Kong | RMB 12,000 | Approx $1,714.29 USD | 0% import duty + customs clearance fee (≤HK$46,000: HK$50.00; >HK$46,000: +HK$0.25 per additional HK$1,000 or fraction; fractions <HK$5: HK$0.10) |

| Macau | RMB 12,000 | Approx $1,714.29 USD | 0% import duty |

| Ireland | EUR 150 (duty on shipping ≤€10 exempt) EUR 22 (VAT on shipping ≤€6 exempt) |

Approx $162.86 USD, duty-free Approx $23.86 USD, VAT-free |

0% - 17% import duty (depending on product) + 23% VAT |

| Austria | EUR 150 – duty-free; EUR 22 – VAT-free; combined duties & VAT ≤€10 exempt |

Approx $162.86 USD, duty-free Approx $23.86 USD, VAT-free |

0% - 17% import duty (depending on product) + 20% VAT |

| Belgium | EUR 150 – duty-free; EUR 22 – VAT-free |

Approx $162.86 USD, duty-free Approx $23.86 USD, VAT-free |

0% - 17% import duty (depending on product) + 21% VAT |

| Portugal | EUR 150 – duty-free; EUR 22 – VAT-free |

Approx $162.86 USD, duty-free Approx $23.86 USD, VAT-free |

0% - 17% import duty (depending on product) + 21% VAT |

| Switzerland | CHF 5 – duty-free; CHF 5 – VAT-free |

Approx $5.88 USD | 133.4 PER/100 kg (fish oil) + 7.7% VAT |

| Greece | EUR 150 – duty-free | Approx $162.86 USD | 0% - 17% import duty (depending on product) + 24% VAT |

| Country / Territory | Duty-Free Allowances | General Trade Import of Supplements / Dietary Supplements Import Duty Rates |

|---|---|---|

| Japan |

Local Currency : JPY 100,000 USD : Approx $75.71 USD |

0% - 5% (depending on product) |

| United States |

Local Currency : None From May 2nd 2025, small parcels under $800 incur duties of 120% of value or $100 per item (whichever is higher); from June 1 2025, the flat fee rises to $200 per item. USD : - |

Import Duty: 145% (as of now) State Sales Tax: TBD |

| Taiwan |

Local Currency : TWD 2,000 USD : Approx $65.71 USD |

5% import duty + 5% business tax |

| Canada |

Local Currency : CAD 20 USD : Approx $15.71 USD |

0% import duty, but 5% - 15% GST/HST applies |

| South Korea |

Local Currency : USD 150 USD : - |

8% import duty + 10% VAT |

| Singapore |

Local Currency : SGD 400 USD : Approx $308.57 USD |

0% import duty, but 8% GST applies |

| Australia |

Local Currency : AUD 1,000 USD : Approx $671.43 USD |

0% import duty, but 10% GST applies |

| Netherlands |

Local Currency : EUR 150 – duty-free; EUR 22 – VAT-free USD : Approx $162.86 USD, duty-free Approx $23.86 USD, VAT-free |

Import Duty: 9% Standard VAT: 21% |

| Germany |

Local Currency : • €45 – duty & VAT-free • €45 - €700 – flat 17.5% on declared value (excl. shipping) • >€700 – standard duties and VAT apply USD : Approx $48.86 USD |

• Up to €150 (~$162.86) tax-free; 19% VAT (7% on some goods) applies • Over €150 (~$162.86): 9% import duty + 19% VAT |

| Italy |

Local Currency : EUR 150 – duty-free; EUR 22 – VAT-free USD : Approx $162.86 USD, duty-free Approx $23.86 USD, VAT-free |

0% - 17% import duty (depending on product) + 22% VAT |

| France |

Local Currency : EUR 150 USD : Approx $162.86 USD |

0% - 17% import duty (depending on product) + 20% VAT |

| Spain |

Local Currency : EUR 150 – duty-free; EUR 22 – VAT-free USD : Approx $162.86 USD, duty-free Approx $23.86 USD, VAT-free |

0% - 17% import duty (depending on product) + 21% VAT |

| New Zealand |

Local Currency : NZD 60 USD : Approx $35.43 USD |

0% import duty + 15% VAT |

| United Kingdom |

Local Currency : GBP 135 – duty-free; GBP 15 – VAT-free USD : Approx $177.43 USD |

0% - 17% import duty (depending on product) + 20% VAT |

| Thailand |

Local Currency : THB 1,000 USD : Approx $30.57 USD |

0% import duty + 7% VAT |

| Indonesia |

Local Currency : USD 3 USD : - |

Imports under $3: duty-free + 11% VAT $3 - $1,500: 7.5% import duty + 11% VAT Over $1,500: Most-Favored-Nation rate (0% duty) + 5% - 15% VAT (12% for fish oil) |

| Malaysia |

Local Currency : RMB 5,000 USD : Approx $714.29 USD |

0% import duty |

| Brazil |

Local Currency : USD 50 – tax-free USD : - |

Import Duty: 9% (simplified regime; goods valued $50 - $3,000 incur a flat 60% CIF-based duty) State Consumption Tax: 17% - 19% (simplified regime: 18% on CIF + import duty) |

| Mexico |

Local Currency : USD 50 – duty & VAT-free USD : - |

10% import duty + 16% VAT + 0.8% deferred tax on CIF + import duty |

| Vietnam |

Local Currency : VND 1,000,000 – duty-free USD : Approx $40.50 USD |

10% import duty + 10% VAT |

| Hong Kong |

Local Currency : RMB 12,000 USD : Approx $1,714.29 USD |

0% import duty + customs clearance fee (≤HK$46,000: HK$50.00; >HK$46,000: +HK$0.25 per additional HK$1,000 or fraction; fractions <HK$5: HK$0.10) |

| Macau |

Local Currency : RMB 12,000 USD : Approx $1,714.29 USD |

0% import duty |

| Ireland |

Local Currency : EUR 150 (duty on shipping ≤€10 exempt) EUR 22 (VAT on shipping ≤€6 exempt) USD : Approx $162.86 USD, duty-free Approx $23.86 USD, VAT-free |

0% - 17% import duty (depending on product) + 23% VAT |

| Austria |

Local Currency : EUR 150 – duty-free; EUR 22 – VAT-free; combined duties & VAT ≤€10 exempt USD : Approx $162.86 USD, duty-free Approx $23.86 USD, VAT-free |

0% - 17% import duty (depending on product) + 20% VAT |

| Belgium |

Local Currency : EUR 150 – duty-free; EUR 22 – VAT-free USD : Approx $162.86 USD, duty-free Approx $23.86 USD, VAT-free |

0% - 17% import duty (depending on product) + 21% VAT |

| Portugal |

Local Currency : EUR 150 – duty-free; EUR 22 – VAT-free USD : Approx $162.86 USD, duty-free Approx $23.86 USD, VAT-free |

0% - 17% import duty (depending on product) + 21% VAT |

| Switzerland |

Local Currency : CHF 5 – duty-free; CHF 5 – VAT-free USD : Approx $5.88 USD |

133.4 PER/100 kg (fish oil) + 7.7% VAT |

| Greece |

Local Currency : EUR 150 – duty-free USD : Approx $162.86 USD |

0% - 17% import duty (depending on product) + 24% VAT |